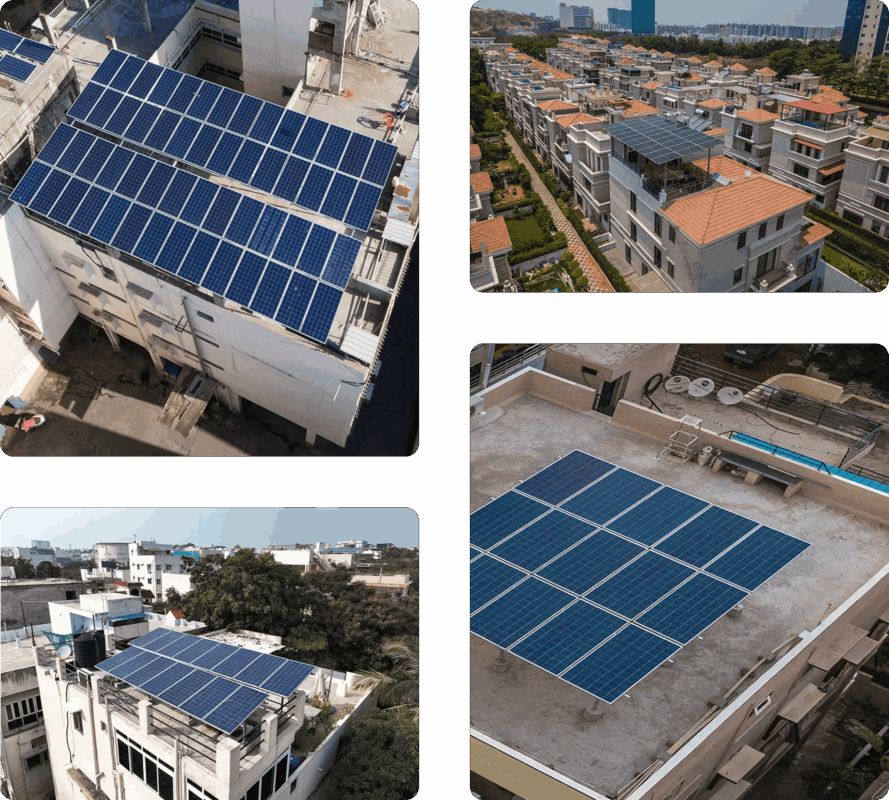

A Complete Guide to Solar Loans for Homes and Businesses by Ecosol

With the world moving towards greener sources of energy, solar power seems to be the first choice for many. Though easily available, it still involves an initial setup cost.

Solar loans are a saviour as they reduce the initial investment significantly. At Ecosol, we make your switch to solar simple, affordable and hassle-free. While solar power offers incredible savings and sustainability, the upfront cost often worries many homeowners and businesses.

That’s where Ecosol steps in — with our flexible solar loan options, partnered with leading banks and NBFCs, we help you go solar without financial stress.

What is a Solar Loan?

A solar loan is a financing solution offered by Ecosol in collaboration with banks and NBFCs. It enables individuals and industries to adopt solar without the financial burden. The availability of solar loans makes solar energy more affordable, as repayment can be made in installments over time.

Solar loans are made available at varying interest rates and flexible tenures. It is important for customers to compare and analyze these factors while choosing a lender.

Features and Benefits of Solar Loans

- 100% Finance Options

Go solar now, pay later with 100% finance option.

- EMIs starting from ₹1,466

Own your solar system with easy EMIs & flexible payment tenures ranging from 6-120 months.

- Instant Loan Approvals

Get quick loan approvals with minimal documentation.

- Easy Accessibility

Since loans reduce the upfront costs, solar installations have become accessible to many homeowners. This way, they can save on their power bills.

Eligibility for Solar Loans

- PM Surya Ghar: Muft Bijli Yojana

- Ecosol provides complete assistance in subsidy applications, handling the entire process from documentation to approval, ensuring a smooth and hassle-free experience for customers.

- The Government of India provides subsidies to make solar power accessible to all residential consumers.

- Through subsidies, they reduce the initial cost and thereby, the dependence on huge loans.

- Public sector banks offer loans to residential customers at concessional rates and flexible repayment options.

- Note: Subsidies apply only if the panels are Made in India.

Why Choose Us?

- Ecosol is your trusted solar partner to make a shift to green energy. We have flexible financing options with 100% finance and easy EMI starting from ₹1,466, making your journey towards solar easier. We have partnered with leading banks and NBFCs and assure you the best solar loan interest rates and flexible repayment options. We have a pan-India presence and have been helping homes and businesses save money and achieve their sustainability goals for more than a decade now.

FAQs

Get all the information you need about our solar, EV charging, and elevator solutions in one place. We’ve compiled answers to the most common questions to make your Ecosol experience simple and hassle-free.

What type of loan is best for solar?

Loans with longer repayment durations have lower EMIs and interest rates, whereas it is vice versa for shorter duration loans. Customers can choose loans for solar installation with a duration best suited to them.

What is the interest rate for solar finance?

Solar panel financing rates typically range between 4% to 10%, depending on the lender.

Am I eligible for subsidy if I take a loan?

Yes, the subsidy is applicable for both finance and non-finance options. Under the PM Surya Ghar Muft Bijli Yojana, the following is the subsidy allowed:

- Up to 2kW systems: INR 30,000 per kW

- For 3kW-10kW systems: INR 78,000

What is the processing fee for a rooftop solar loan application?

At Ecosol, the processing fee for a solar loan is 2%.

How much is the down payment for a solar system?

Down payment is 20% but can vary between 10% and 20%, depending on the project value.